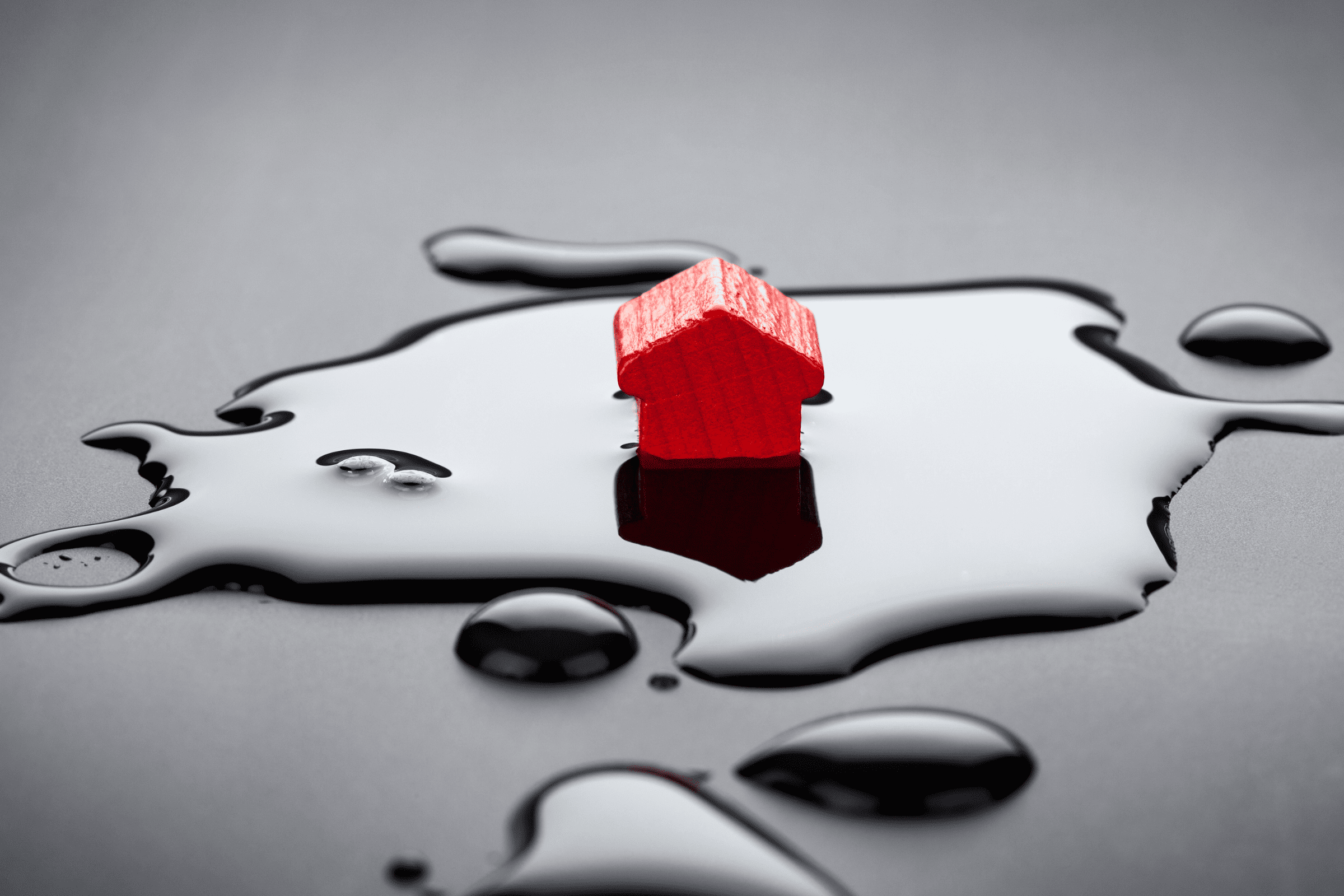

When flood strikes, the aftermath can be overwhelming, leaving property owners facing both physical and financial challenges. Swift action is crucial to minimize the damage and prevent further complications, from structural issues to mould growth. In addition to the immediate repairs required, understanding the financial options available is essential for managing the costs associated with restoring a property.

In this article, we explore the importance of timely flood repairs, the risks of delaying action, and the various financial solutions that can help homeowners navigate the road to recovery.

Why Fixing Flood Damage Quickly Matters

When a property is hit by a flood, the damage can be extensive and multifaceted. Water can seep into the foundations, weaken structural elements, and create a conducive environment for mould growth. The following are some critical reasons why immediate repairs are crucial:

Prevent Structural Damage

Water exposure is known to compromise the structural integrity of your property – even more when you consider many houses in Australia are made of wood or concrete. Immediate repairs help prevent the weakening of walls, foundations, and support beams.

Mitigate Mould Growth

Mould thrives in damp conditions and can begin to grow within 24-48 hours after a flood. This is even worse when there’s five classes of moulds known to grow in Australia, with black water mould the most lethal.

Immediate drying and remediation efforts are essential to prevent mould from spreading and causing health issues.

Protect Electrical Systems

Water can damage electrical systems, posing a significant safety risk. Prompt repairs ensure that electrical components are checked and restored safely.

Reduce Long-Term Costs

Addressing flood damage quickly can prevent further deterioration, reducing the overall repair costs. Delaying repairs can lead to more extensive damage, which is more expensive to fix.

Finance Options for Managing Flood Repair Costs

Given the high costs associated with flood repairs, it’s essential for property owners to be aware of the various finance methods available in Australia to manage these expenses. Here are some options to consider:

Flood Insurance

One of the primary financial protections against flood damage is flood insurance. This type of insurance covers the cost of repairs and replacements for property and contents damaged by flooding. However, it is crucial to understand the specifics of your policy, as coverage can vary significantly.

- Comprehensive Policies: Some home insurance policies include flood cover as part of their comprehensive package. Check with your insurer to confirm if your policy includes this protection.

- Add-On Policies: If your standard home insurance does not cover floods, you may need to purchase an add-on policy specifically for flood damage.

Government Assistance

In the wake of significant flooding events, the Australian government often provides financial assistance to affected property owners. These programmes can help cover the costs of repairs and provide relief during the recovery process.

- Disaster Recovery Payments: The government may offer lump-sum payments to individuals who have suffered significant losses due to flooding.

- Disaster Recovery Loans: Low-interest loans may be available to help property owners repair or replace damaged assets.

- Buy-Backs: The federal government may offer affected residents a chance to resettle elsewhere by offering to buy back their damaged properties. This is already critical when a check of the property reveals that it is no longer liveable or the homeowner may spend a large amount of money for the repairs but the work may not be up to code.

Bank Loans and Lines of Credit

For those who need additional funds beyond what insurance or government assistance provides, bank loans and lines of credit can be viable options. These financial products offer flexibility in managing repair costs.

- Personal Loans: Many banks offer personal loans specifically for home repairs, programmed with fixed interest rates and repayment terms.

- Home Equity Loans: If you have equity in your property, you might consider a home equity loan, which allows you to borrow against the value of your home.

- Lines of Credit: A line of credit provides a revolving credit limit that you can draw from as needed, offering flexibility in managing repair expenses.

The Australian banking industry, though, may exercise some consideration with repayments for existing loans after a major disaster like a flood. In the wake of the South East Queensland-northern NSW floods in early 2022, for example, the Australian Banking Association announced that member-banks had defer loan repayments for as long as three months, which will apply to home and personal loans, plus certain business loans.

Payment Plans with Contractors

Some contractors and repair companies offer payment plans that allow you to spread the cost of repairs over time. This can be a helpful option if you need immediate repairs but want to avoid taking on large loans.

- Interest-Free Plans: Some companies offer interest-free payment plans for a set period, making it easier to manage costs without incurring additional interest.

- Flexible Terms: Payment plans with flexible terms can be negotiated directly with contractors to suit your financial situation.

Steps to Manage Flood Damage and Finances

The emotional and mental stress people experience after a flood may tend to overwhelm the need for rational thinking, especially when repair funds are a big question to answer.

Assess the Damage

Before seeking financial assistance, thoroughly assess the extent of the damage. Document everything with photos and detailed descriptions to support your claims or loan applications.

Review Insurance Policies

Carefully review your insurance policies to understand your coverage limits and exclusions. Contact your insurer immediately to initiate the claims process.

Explore All Options

Consider all available finance methods, including insurance, government assistance, loans, and payment plans. Choose the option that best suits your financial situation and repair needs.

Get Multiple Quotes

Obtain quotes from several contractors to ensure you are getting a fair price for the repairs. This can also help in negotiating payment plans or loans. Even in tallying the quotes, you must also check their credentials with your state or territory’s contractor licence registry; NSW Fair Trading, in particular, states that some tradies or possibly unlicenced contractors usually come knocking after a flood offering their services. Do not pay anything without a formal contract.

Prioritise Repairs

Focus on the most critical repairs first, such as structural issues and mould remediation. This ensures that your property is safe and habitable while you manage other less urgent repairs.

Stay Informed

Keep up-to-date with any new government assistance programmes or changes to insurance policies that may benefit you. Local councils and community organisations can be valuable sources of information and support.

Conclusion

Floods can cause significant damage to properties, but immediate repairs are essential to mitigate further harm and reduce overall costs. Understanding the various finance methods available in Australia, including flood insurance, government assistance, bank loans, and payment plans with contractors, can help property owners manage the financial burden of flood repairs.

By assessing the damage, reviewing insurance policies, exploring all options, and prioritising critical repairs, you can effectively navigate the challenges of funding your property’s flood repair and restore your home to its pre-flood condition.

DISCLAIMER: This article is for informational purposes only and does not supersede existing advice on home repair or finance. 2 Ezi has no business relationships with any government office, home contractor, or emergency management agency.